India's ship repair sector holds immense untapped potential due to its strategic location and growing infrastructure. Currently, the country accounts for less than 1% of the global ship repair market, but with almost 7-9% of international traffic passing within 300 nautical miles of our coastline, India has the opportunity to become a global repair hub (Maritime Amrit Kaal Vision, 2023). India’s annual ship repair market is currently estimated to be roughly Rs. 2000 crore (240 million USD), with an overall unrealised current potential of Rs. 6000 crore. Further, over the next 10 years, India has potential to create Rs. 14000+ crore (1.7 billon USD), ship repair market which is critical to indigenize the ship repair business in the country (Cochin Shipyard Limited, 2023).

MIV 2030 has set a bold target to elevate India's global ranking in shipbuilding and ship repair from over 20th place to the top 10 and an ambitious goal has been set for the top 5 position, as outlined in the Amrit Kaal Vision 2047 (PIB, 2024). The demand for ship repair and maintenance is driven by routine servicing to ensure vessel efficiency, unscheduled repairs due to breakdowns, and Port State Control inspections enforcing safety compliance. Additionally, the rising cost and long delivery times of new vessels have increased demand for ship retrofits, modifying existing ships for new functions or environmental compliance. As global trade expands and the global fleets ages, the demand for repair, maintenance, and retrofit services is growing (OECD, 2010). India's key strengths in this sector include low labour costs, a strategic location along major shipping routes, and strong government support (including the financial subsidies introduced this year budget 2025-26).

Key Challenges in the Ship Repair Industry

India’s ship repair sector is constrained by a range of structural and operational challenges, primarily due to inadequate infrastructure, lack of ancillary support, and complex regulatory procedures. Despite having 41 shipyards—two under the Ministry of Ports, Shipping & Waterways, four under the Ministry of Defence, two under state governments, and 33 in the private sector—almost all of these yards are focusing on building warships rather than repairs. Few shipyards also lack the ecosystem to cater to specialized vessels and cannot accommodate large ships due to shallow drafts at repair ports. This has resulted in losing the ship-repair business to countries like China, Singapore, and the UAE.

In 2023-24, only 418 ships were repaired, with 227 handled by the private sector, remaining by the public sector. Further, with only 42 dry docks and limited crane availability, Indian shipyards struggle to compete with China (450), South Korea(400), and U.S(117), which have significantly more shipyard capacities. (MoPSW, 2025)

Source: Derived from MoPSW, Statistics of India’s Shipbuilding and Ship Repairing Industries 2024

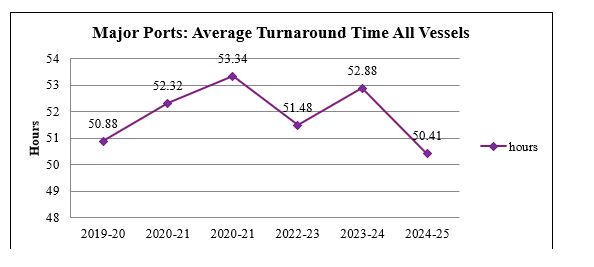

Additionally, the lack of a strong ancillary ecosystem compels shipyards to import spare parts from Europe, Japan, and the U.S., making repair costs 1.4 times and turnaround time 1.4 to 1.6 times of that in global repair yards (Crisil 2025).

India's Logistics Performance Index (LPI) rankings over the years reflect the persistent bottlenecks in trade facilitation and supply chain efficiency, which directly impact the ship repair industry. Cumbersome customs procedures further delay the procurement of critical components, increasing downtime for vessels. The stringent conditions for setting up Free Trade Warehousing Zones (FTWZ) hinder foreign companies' collaboration with Indian shipyards, limiting industry growth.

Source: Authors Compilation

Cargo Volume and Vessel Type Insights

Total Volume of Cargo Handled at Major Ports in year 2022–23 GRT (‘000)

Source: Derived from Basic Port Statistics 2022-23.pdf

The port-wise vessel handling patterns provide a strong basis for region-specific ship repair clusters. Liquid bulk-heavy ports like Deendayal are suited for tanker services, while Paradip and Visakhapatnam align with dry bulk repairs. Container hubs such as JNPT and Chennai are ideal for equipment and reefer servicing. Aligning repair infrastructure with vessel specialization can enhance efficiency, reduce costs, and improve India’s competitiveness in the global ship repair market.

Global Comparison

Countries like China, Singapore, Korea and UAE dominate the global ship repair market with advanced infrastructure, skilled workforces, and efficient operations, while India remains a minor player despite its potential. The global ship repair market is approximately worth $12 billion and projected to reach $40 billion by 2030, presenting growth opportunities for India (Crisil, 2025).

South Korea supports its ancillary industry through incentives, R&D, and business networks, a model India can adopt (DSIR, 2019). Singapore thrives on free trade, tax incentives, and a well-integrated supply chain, attracting foreign investment. (Tang, 2024)

Way Forward

India’s ship repair industry holds immense potential, but unlocking this growth requires a focused and phased approach. Firstly, infrastructure development must be prioritized. Just as dedicated MRO hubs are being set up near major airports to serve aircraft maintenance needs (The Hindu, 2025), India should adopt a similar model for maritime infrastructure by establishing specialized ship repair clusters at major ports. Initiatives like the International Ship Repair Facility (ISRF) and the new dry dock at Kochi are steps in the right direction. India should scale this model by creating dedicated maritime MRO zones across key coastal locations. These clusters, modeled after global leaders such as China, Japan, and Singapore, would allow for localized specialization, operational efficiency, and quicker turnaround times. Secondly, strengthening the ancillary industry is crucial to reduce dependence on imports. Promoting domestic manufacturing of spare parts, facilitating Authorized Economic Operator (AEO) certification for ship-repair yards to accelerating spare imports, and creating Free Trade Warehousing Zones will streamline supply chains and enhance cost competitiveness. Encouraging collaborations with established maritime nations like Korea, Japan, and Singapore will also bring in technological know-how, joint training, and co-investments in advanced facilities.Thirdly, research and development should be at the core of India’s ship repair transformation. Establishing a Centre of Excellence (CoE) for ship repair can drive innovation in eco-friendly technologies and up skilling. This becomes even more critical as the world pivots to green shipping. India, through its Green Hydrogen Mission, is well-placed to lead in retrofitting vessels for green propulsion. By aligning infrastructure expansion, policy reform, and innovation, India can position itself as a global hub for ship repair. Focused efforts can generate significant economic benefits and elevate India’s standing in the global maritime landscape.

References:

- MoPSW (2023). Maritime Amrit Kaal Vision 2047. [https://shipmin.gov.in/content/amrit-kaal-2047]

- PIB (2024). Press Release on Maritime India Vision. https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2030843]

- Cochin Shipyard Limited (2023). Investor Presentation. [https://cochinshipyard.in/uploads/investor/cc0e2dab42845295aaa63700d27b05ed.pdf]

- MoPSW (2025). Statistics of India’s Shipbuilding and Ship Repairing Industries 2024. [https://shipmin.gov.in/sites/default/files/SBR%202023-24%20%283%29.pdf]

- CRISIL (2025). Forging New Horizons: Indian Maritime Sector Outlook. [https://www.crisil.com/content/dam/crisilcom2-0/our-analysis/reports/corporate/2025/02/forging-new-horizons/forging-new-horizons.pdf]

- DSIR (2019). Innovation Ecosystem in Ancillary Industries. https://www.dsir.gov.in/sites/default/files/2019-11/9_7.pdf]

- Tang (2024). Research on the Development and Policies of the Port of Singapore Harbor. [https://www.researchgate.net/publication/380502052_Research_on_the_Development_and_Policies_of_the_Port_of_Singapore_Harbor]

- OECD (2010). OECD Journal: General Papers, Volume 2010 Issue 3.

- The Hindu (2025), https://www.thehindu.com/news/cities/bangalore/indigo-to-build-another-mro-facility-at-kempegowda-international-airport-in-bengaluru/article69636931.ece

- Basic Port Statistics 2022-23.pdf

* Namita Mittal is a Research Assistant at CMEC (RIS). Views expressed are personal. Usual disclaimer applies. Author can be reached out at namita.mittal@ris.org.in